The largest single obstacle blocking resolution to the current unfortunate relationships between capital markets and corporations is the difficulty in precisely defining and sharing the points of contention and discussion required for “fruitful dialogue”.

Unless the essential nature of the discussion and the boundaries of the points at issue can be determined and agreed-upon, it is easy for shareholder proposals to devolve into unilateral, fragmentary or short-sighted perspectives, simply results in companies rejecting these proposals, fending them off as if playing whack-a-mole.

Companies also bear responsibility for this situation, as in many cases, companies are failing to clearly convey to shareholders the approaches, policies and scenarios that will maximize the company’s intrinsic and potential value.

That is why the true significance of promoting “engagement” lies in defining and making visible the path to increased corporate value.

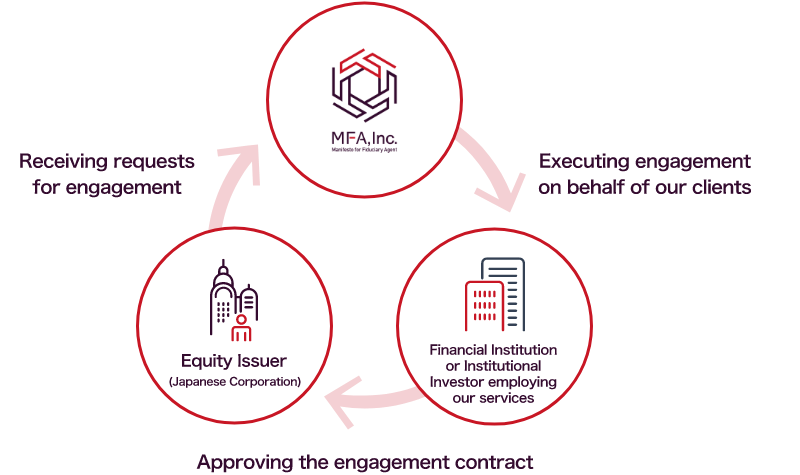

This is also why “engagement” by financial institutions and institutional investors, who only have a limited share of a company’s equity holdings, is so important. These institutions can encourage companies to explain their management policies in a rigorous way that not only stands up to scrutiny, but also raises awareness among other shareholders and stakeholders of the appropriate long-term path required to harness intrinsic value.

In this way, institutional investors can lead other shareholders, and their “engagement” can form a core around which shareholder opinion can coalesce.

In between the needlessly confrontational shareholders who see only short-term perspectives, and the excessively passive shareholders who accept every management proposal without question, we need shareholders who support of management but still say what needs to be said. These are the shareholders exercising “fiduciary duty”.

MFA’s third mission, is to act on behalf of the financial institutions and institutional investors with that responsibility, taking action to sow the seeds of this movement.

▼Publisher’s comment

The author, who has a wealth of experience in providing management consulting services to various companies and talking to business leaders, presents his views on business management. How can business leaders find freedom from the corporate labyrinth? This book provides some answers to that question, as well as explanations of the true meaning of various business terms such a “strategy”, “organization” and “M&A”.